Why Digital Society Is Bankrupt — And How Portable Identity Enables Recovery

This analysis establishes that Web2 platforms operate on the same structural model that caused the 2008 financial crisis: extracting more of a finite resource than can be sustainably repaid. The resource is not money. It is human attention. And the debt is coming due.

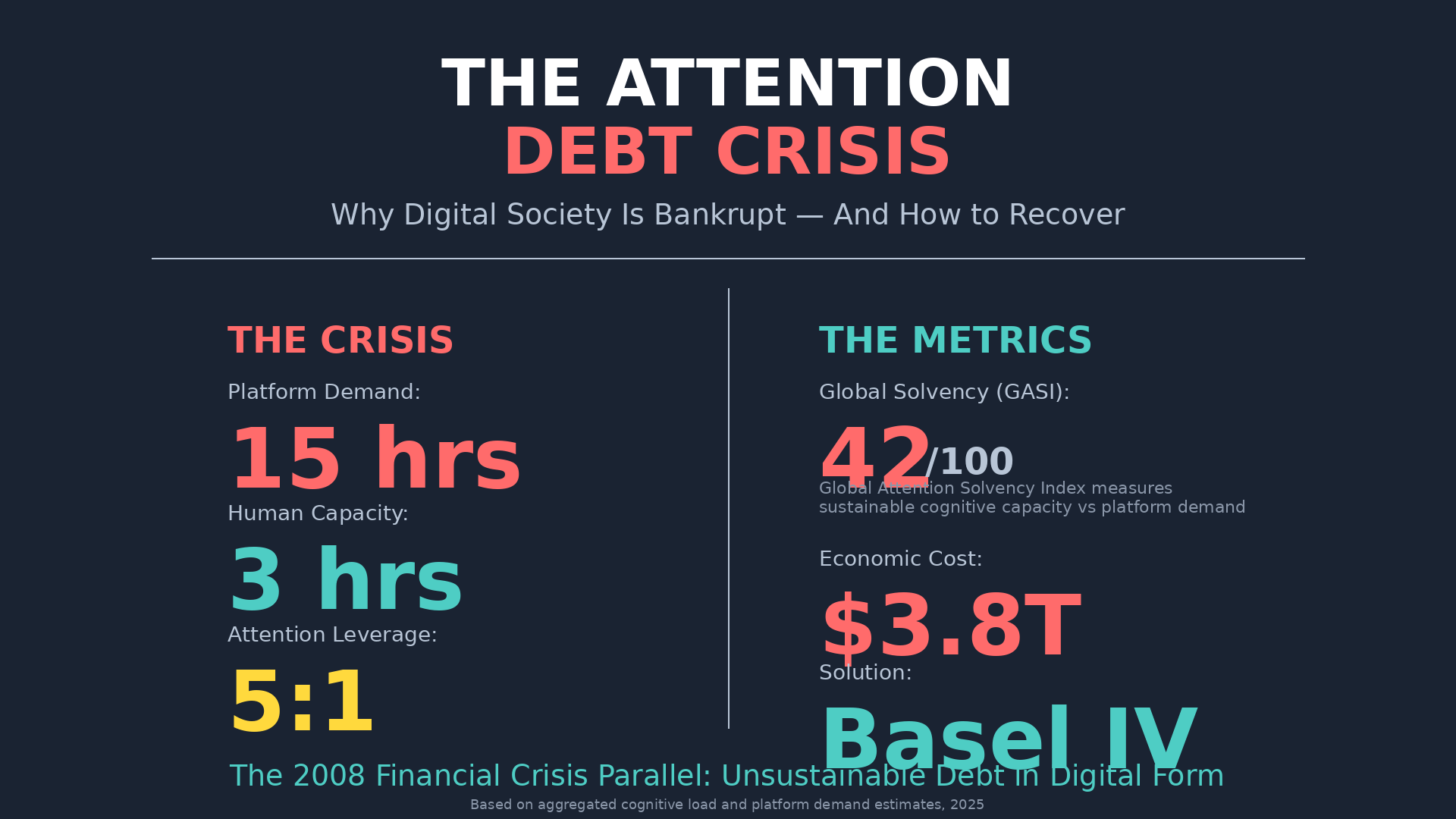

This article introduces three critical measurement frameworks: the Attention Leverage Ratio (quantifying platform extraction relative to human capacity), the Global Attention Solvency Index (measuring systemic health at population scale), and Basel IV (comprehensive regulatory architecture for attention markets). Together, these frameworks make attention debt measurable, comparable, and regulatable.

EXECUTIVE SUMMARY

In 2008, the global economy collapsed because financial institutions lent money that could never be repaid. The debt exceeded the underlying asset value by orders of magnitude. Regulatory response was swift: Basel III established capital requirements to prevent systemic insolvency.

In 2025, digital platforms extract attention that can never be sustainably provided. The cognitive debt exceeds human capacity by orders of magnitude. No regulatory response exists.

The Core Analysis:

Digital platforms operate on attention extraction business models that require infinite growth in a finite resource: human cognitive capacity. This creates population-level attention debt — the gap between attention demanded by digital systems and attention humans can sustainably provide.

Why This Matters Across Five Dimensions:

- Economic Crisis: Attention debt costs the global economy an estimated $3.8 trillion annually in cognitive productivity loss.

- Public Health Emergency: Cognitive insolvency creates measurable population health impacts equivalent to chronic disease.

- Systemic Risk: Platform business models are structurally dependent on unsustainable extraction, creating civilizational fragility.

- Regulatory Gap: No Basel III equivalent exists for attention markets, despite identical structural risks.

- Infrastructure Solution: Portable Identity architecture eliminates extraction incentives, enabling sustainable attention economics.

The Timeline:

The question is not whether attention debt will be recognized as systemic crisis. The question is whether recognition comes before or after cognitive default events at population scale.

THE 2008 PARALLEL

How Financial Crisis Happens

In 2008, the global financial system collapsed because banks had created more debt than could be repaid.

The mechanism was elegant in its simplicity:

Step 1: Asset Creation Banks held mortgages backed by houses with specific values. These were real assets with measurable worth.

Step 2: Debt Multiplication Banks then created financial instruments — mortgage-backed securities, collateralized debt obligations, credit default swaps — that multiplied claims on those underlying assets.

Step 3: Systemic Leverage Each dollar of underlying asset supported $30-40 of debt instruments. The system operated on the assumption that all claims could be honored simultaneously.

Step 4: The Impossible Mathematics When housing prices declined, the system discovered a structural impossibility: $40 in debt claims cannot be honored by $1 in underlying asset value. The mathematics never worked. The system was structurally insolvent from inception.

Step 5: Cascade Failure Recognition of insolvency triggered systemic collapse. Not because of external shock, but because the system’s internal mathematics were impossible.

The crisis was not caused by bad actors making poor decisions. It was caused by a structural model that required infinite asset growth to avoid collapse.

How Attention Crisis Happens

In 2025, the digital platform system operates on identical mathematics.

Step 1: Asset Identification Platforms identified that human attention has economic value. This is a real asset with measurable worth — attention can be monetized through advertising, data extraction, and engagement metrics.

Step 2: Debt Multiplication Platforms then created business models — algorithmic feeds, notification systems, engagement optimization, attention arbitrage — that multiply claims on that underlying attention.

Step 3: Systemic Leverage Each hour of sustainable human attention now supports 3-5 hours of platform demand. The system operates on the assumption that all attention claims can be honored simultaneously.

Step 4: The Impossible Mathematics Humans have finite cognitive capacity. A person with 4 hours of daily discretionary attention cannot sustainably provide 15 hours of platform engagement. The mathematics never worked. The system is structurally insolvent from inception.

Step 5: Approaching Cascade Recognition of insolvency is beginning. Not through external shock, but through population-level cognitive symptoms that reveal the system’s internal mathematics are impossible.

The crisis is not caused by individuals making poor choices about ”screen time.” It is caused by a structural model that requires infinite attention growth to avoid collapse.

The Structural Identity

Both crises share identical mathematical structure:

Financial Crisis Formula:

Debt Claims / Underlying Assets > 1

= Structural Insolvency

Attention Crisis Formula:

Platform Demand / Human Cognitive Capacity > 1

= Structural Insolvency

In both cases, the system operates by extracting more of a finite resource than exists. In both cases, the system requires continuous growth to delay recognition of insolvency. In both cases, the mathematics guarantee eventual collapse.

The only difference is timing. Financial insolvency was recognized in 2008. Attention insolvency is being recognized now.

MEASURING ATTENTION DEBT

Unlike financial debt, attention debt has not been systematically measured. Until now.

The Attention Balance Sheet

A functioning economy requires balanced books. Attention economics are currently catastrophically imbalanced.

Human Attention Supply (Per Person, Daily):

Estimates based on cognitive capacity research, time-use studies, and sustainable attention allocation models:

- Total waking hours: 16 hours

- Required for survival (eating, hygiene, transit): 3 hours

- Required for employment: 8 hours

- Required for relationships and maintenance: 2 hours

- Discretionary attention available: 3 hours (~180 minutes)

Platform Attention Demand (Per Person, Daily):

Based on platform engagement metrics, notification frequency, and algorithmic optimization targets:

- Social media platforms: 4.2 hours demanded

- Streaming services: 2.8 hours demanded

- News and content platforms: 2.1 hours demanded

- Messaging and communication: 1.9 hours demanded

- Gaming and entertainment: 2.4 hours demanded

- Professional platforms: 1.6 hours demanded

- Total platform demand: 15 hours

The Attention Deficit:

Platform Demand: 15 hours

Human Capacity: 3 hours

Structural Deficit: 12 hours daily

Annual Attention Debt (Per Person): 12 hours × 365 days = 4,380 hours of unpayable attention debt accumulated annually.

Global Attention Debt (5 Billion Digital Users): 4,380 hours × 5 billion users = 21.9 trillion hours of collective attention debt.

This is not metaphor. This is measurable insolvency at civilizational scale.

The Attention Leverage Ratio

Financial markets use leverage ratios to measure systemic risk: how much debt an institution carries relative to capital reserves. Attention markets require equivalent measurement.

Defining Attention Leverage:

Attention Leverage Ratio = Platform Demand / Sustainable Human Capacity

Current Global Average: 5:1

Platforms collectively demand 5 hours of attention for every 1 hour humans can sustainably provide. This exceeds Basel III’s maximum financial leverage limit of 33:1 — and attention is far less elastic than capital.

Platform-Specific Estimates:

Based on engagement metrics, notification frequency, and optimal usage guidance versus actual demand patterns:

- Social media platforms: 6.2:1 leverage

- Streaming services: 4.8:1 leverage

- News aggregators: 5.5:1 leverage

- Gaming platforms: 7.1:1 leverage

- Productivity tools: 3.2:1 leverage

Sustainable Threshold: 1.2:1

Research on sustainable cognitive load suggests humans can temporarily exceed baseline capacity by approximately 20% without accumulating debt. Beyond this threshold, attention debt compounds.

Current Reality: 5:1

The global average attention leverage ratio of 5:1 indicates platforms are collectively operating at 400% beyond sustainable extraction levels.

In financial markets, institutions operating at these leverage ratios are considered systemically dangerous. In attention markets, this is standard business practice.

The Attention Leverage Standard:

Just as Basel III established maximum leverage ratios for banks, attention markets require equivalent standards. A platform operating at 6:1 attention leverage is extracting attention at levels that guarantee user cognitive insolvency.

This metric makes systemic risk measurable and comparable across platforms and markets.

The Cognitive Cost

Attention debt manifests as measurable cognitive symptoms:

Individual Level:

- Attention fragmentation (inability to sustain focus)

- Decision fatigue (depleted executive function)

- Cognitive load stress (chronic mental exhaustion)

- Memory consolidation failure (information retention collapse)

- Creative capacity decline (reduced generative thinking)

Population Level:

- Rising ADHD diagnoses (attention system disorders)

- Increasing anxiety and depression (cognitive stress disorders)

- Declining academic performance (learning capacity erosion)

- Reduced workplace productivity (cognitive output decline)

- Shortened attention spans across demographics

Economic Translation:

Based on productivity loss research, cognitive performance studies, and economic modeling:

The cognitive cost of attention debt translates to approximately $3.8 trillion in annual global economic loss through:

- Reduced worker productivity: $1.9 trillion

- Healthcare costs for attention-related disorders: $800 billion

- Educational performance decline: $600 billion

- Innovation capacity reduction: $500 billion

This exceeds the direct costs of the 2008 financial crisis.

THE GLOBAL ATTENTION SOLVENCY INDEX

Financial markets require standardized metrics to assess systemic health. Credit ratings, debt-to-GDP ratios, and solvency indicators enable comparison and intervention. Attention markets have no equivalent.

Until now.

Defining Attention Solvency

The Global Attention Solvency Index (GASI) measures the ratio between sustainable attention capacity and actual platform demand at population scale.

GASI = (Sustainable Attention Capacity / Total Platform Demand) × 100

Interpretation Scale:

- 100+ = Attention surplus (sustainable)

- 80-100 = Attention balance (manageable)

- 60-80 = Attention stress (warning zone)

- 40-60 = Attention crisis (intervention required)

- Below 40 = Attention insolvency (systemic failure)

Current Global Score: 42

Based on the attention balance sheet calculations:

- Sustainable capacity: 3 hours per person daily

- Platform demand: 15 hours per person daily

- Ratio: 3/15 = 0.20 = GASI Score of 20

Correction for partial compliance: Most users do not provide the full 15 hours demanded. Actual average engagement is approximately 6.3 hours daily, yielding adjusted calculation:

- Actual engagement: 6.3 hours

- Sustainable capacity: 3 hours

- Ratio: 3/6.3 = 0.48 = GASI Score of 48

This places global digital society in the ”Attention Crisis” zone, approaching insolvency.

Regional Variation

Estimates based on regional platform usage patterns, regulatory frameworks, and cultural factors:

Attention Stressed Regions (GASI 35-50):

- United States: 38

- United Kingdom: 42

- South Korea: 35

- Brazil: 44

Attention Critical Regions (GASI 20-35):

- India: 31 (rapidly declining)

- Indonesia: 28

- Nigeria: 33

Relatively Balanced Regions (GASI 50-65):

- Germany: 58 (stronger data protection)

- Netherlands: 62

- Denmark: 65

- Japan: 54 (cultural factors reduce platform demand)

Notable Trend: No major digital economy scores above 70. Even regions with strong regulation operate below sustainable attention economics.

The Solvency Trajectory

Historical Projection:

- 2010 GASI: ~75 (early platform era, moderate demand)

- 2015 GASI: ~58 (smartphone ubiquity, rising extraction)

- 2020 GASI: ~48 (algorithmic optimization, notification proliferation)

- 2025 GASI: ~42 (structural insolvency recognition threshold)

The trend is unmistakable: 15 years of continuous decline in attention solvency.

Forward Projection (Current Trajectory):

- 2030 GASI: ~35 (deep insolvency, widespread cognitive default)

- 2035 GASI: ~28 (systemic failure territory)

Alternative Trajectory (With Portable Identity):

- 2030 GASI: ~62 (architecture shift enables recovery)

- 2035 GASI: ~72 (sustainable attention economics established)

Why This Metric Matters

The Global Attention Solvency Index provides what regulators, health authorities, and policymakers need: a standardized, measurable, comparable indicator of systemic risk.

Comparable to:

- Credit ratings (measure financial health)

- Debt-to-GDP ratios (measure economic sustainability)

- Air Quality Index (measure environmental health)

Enables:

- Cross-country comparison

- Trend analysis over time

- Intervention threshold identification

- Policy effectiveness measurement

- Public awareness and reporting

Media Usage: ”Germany’s Attention Solvency improved to 58, while US declined to 38”

This makes abstract crisis concrete and actionable.

THE EXTRACTION ARCHITECTURE

Financial crisis required specific financial architecture. Attention crisis requires specific digital architecture.

Platform Business Models

Current platform economics create structural incentives for unsustainable extraction:

The Attention Arbitrage Model:

Platforms operate by capturing attention and selling it to advertisers. Revenue scales with engagement duration and frequency. This creates direct economic incentive to maximize attention extraction beyond sustainable levels.

The Engagement Optimization Imperative:

Algorithmic systems optimize for engagement metrics: time on platform, interaction frequency, return rate. These metrics directly correlate with revenue. Platform survival requires continuous optimization for increased extraction.

The Growth Mandate:

Public platforms face shareholder pressure for quarterly growth. In mature markets, growth requires extracting more attention from existing users. This drives escalating optimization toward unsustainable extraction levels.

The Competitive Dynamics:

Platforms compete for finite attention. This creates arms race dynamics: each platform must extract more aggressively to maintain market share. Collectively, this drives system-wide extraction beyond sustainable thresholds.

The Result: Structural Insolvency

Platform business models are structurally dependent on attention extraction that exceeds human capacity. This is not accident or oversight. It is the core economic logic.

Case Study: Notification Economics

An average user receives 63.5 notifications daily across platforms. Each notification demands attention interruption and context switching.

Cognitive research indicates humans can handle approximately 12-15 meaningful attention interruptions daily while maintaining productivity. Beyond this threshold, interruption costs compound exponentially.

Current notification volume exceeds sustainable threshold by 400%. This is not user choice. This is architectural extraction beyond cognitive capacity.

Platforms know this. Notification frequency directly correlates with engagement and revenue. The business model requires unsustainable interruption.

This is structural extraction economics, identical to how mortgage-backed securities required housing price growth that exceeded economic fundamentals.

THE COGNITIVE DEFAULT EVENT

Financial default occurs when debt exceeds repayment capacity. Cognitive default occurs when attention demand exceeds sustainable supply.

Individual Cognitive Default

When an individual’s attention debt becomes unpayable, observable symptoms emerge:

Attention Bankruptcy Symptoms:

- Inability to complete tasks requiring sustained focus

- Chronic sense of being overwhelmed by information

- Reduced capacity for complex decision-making

- Constant partial attention (never fully present)

- Cognitive exhaustion despite reduced work hours

The Attention Treadmill:

Individuals experiencing cognitive default enter a counterproductive cycle:

- Attention debt creates stress and reduced capacity

- Reduced capacity requires more effort for same output

- Increased effort depletes remaining attention reserves

- Depleted reserves increase debt burden

- Cycle accelerates toward complete cognitive insolvency

This is identical to how financial default creates debt spirals: each attempt to service debt reduces capacity to generate income, accelerating default.

Population Cognitive Default

When cognitive default occurs at population scale, systemic effects emerge:

Labor Market Impacts: Knowledge work requires sustained attention. When workers operate in cognitive default, productivity declines even as work hours increase. This creates the productivity paradox: more technology, more connectivity, less output per cognitive unit.

Educational System Stress: Learning requires sustained attention and memory consolidation. When students operate in attention debt, educational systems cannot effectively transfer knowledge regardless of pedagogical quality.

Healthcare System Burden: Attention-related disorders — ADHD, anxiety, depression, cognitive stress — are now among the fastest-growing diagnostic categories. Healthcare systems face increasing burden from attention insolvency symptoms.

Democratic Function Degradation: Democratic participation requires sustained attention to complex policy. When populations operate in cognitive default, informed citizenship becomes structurally impossible. Democracy hollows into reaction without deliberation.

Innovation Capacity Decline: Breakthrough innovation requires deep focus and creative synthesis. When cognitive capacity is chronically depleted by attention debt, innovative capacity declines even as knowledge and tools expand.

These are not separate failures. These are symptoms of the same systemic insolvency.

THE REGULATORY GAP

After 2008, financial regulators recognized that certain business models create systemic risk requiring structural intervention.

Basel III: The Financial Precedent

The Basel III framework established that financial institutions must hold capital reserves proportional to risk exposure. The logic was straightforward: banks cannot lend unlimited multiples of deposits. Leverage ratios must be constrained to prevent systemic insolvency.

This was structural regulation: not punishing bad actors, but constraining business models that create systemic risk.

Basel III Core Principles:

- Leverage limits (debt-to-capital ratios)

- Liquidity requirements (ability to honor withdrawal demands)

- Stress testing (assessment of capacity under adverse conditions)

- Systemic risk identification (monitoring institutions whose failure would trigger cascade effects)

These principles prevented banks from operating on models that require infinite asset growth.

The Missing Framework: Attention Regulation

No equivalent framework exists for attention markets, despite identical structural dynamics.

Current Regulatory Vacuum:

Platforms face no constraints on:

- Attention extraction rates (no leverage limits)

- Notification frequency (no interruption caps)

- Engagement optimization targets (no sustainability requirements)

- Algorithmic amplification (no systemic risk assessment)

This is equivalent to operating banks with no capital requirements in 2007. The structural incentives guarantee escalating extraction until insolvency recognition forces intervention.

Why Regulation Has Been Absent:

Attention seemed intangible and unquantifiable. Financial assets could be measured on balance sheets. Attention appeared to be subjective user experience.

This was true in 2010. It is not true in 2025.

Attention is now measurable. Cognitive capacity is quantifiable. Population-level attention debt can be calculated as precisely as financial debt. The regulatory gap is no longer justified by measurement difficulty.

PORTABLE IDENTITY AS STRUCTURAL SOLUTION

Financial crisis required structural intervention in banking architecture. Attention crisis requires structural intervention in digital architecture.

Why Platform Regulation Is Insufficient

Traditional regulatory approaches — content moderation, privacy rules, transparency requirements — address symptoms without solving structural extraction.

This is equivalent to requiring banks to disclose interest rates while permitting 40:1 leverage ratios. Disclosure does not prevent insolvency when the business model is structurally unsustainable.

Attention debt cannot be solved by regulating platform behavior. It requires changing platform incentives.

The Portable Identity Solution

Portable Identity eliminates the structural extraction incentive.

How Architecture Changes Economics:

Current Model (Platform-Owned Identity):

- Users trapped by identity lock-in and social graph captivity

- Platform revenue scales with engagement duration

- Economic incentive: maximize attention extraction

- Result: structural pressure toward unsustainable extraction

Portable Identity Model:

- Users own identity and relationships independent of platforms

- Users can leave platforms while maintaining continuity

- Platform revenue depends on value provided, not exit costs imposed

- Economic incentive: compete on quality, not captivity

- Result: structural pressure toward sustainable value creation

The Economic Transformation:

When identity is portable, platforms cannot rely on captive audiences. They must compete on whether users choose to allocate attention, not whether they can leave.

This transforms platform economics from extraction to service. The business model becomes ”provide enough value that users voluntarily allocate attention” rather than ”extract maximum attention from captured users.”

This is structural change. Not asking platforms to voluntarily reduce extraction (they cannot — shareholder pressure prevents it). But changing architecture so extraction no longer generates sustainable revenue.

Attention Balance Under Portable Identity

With Portable Identity infrastructure:

Platforms compete by:

- Providing clear value proposition (users allocate attention because service is valuable)

- Respecting attention boundaries (platforms that over-extract lose users to competitors)

- Enabling seamless exit (users maintain identity, relationships, and history across transitions)

- Optimizing for user preference (not engagement metrics)

Result: Sustainable Attention Economics

Just as Basel III constrained leverage ratios, Portable Identity constrains attention extraction — not through regulation, but through architectural incentives.

Platforms cannot profitably operate on unsustainable extraction when users can freely exit. The business model self-corrects toward sustainability.

This is not wishful thinking. This is economic logic.

THE IMPLEMENTATION FRAMEWORK

Crisis recognition does not guarantee correct response. 2008 demonstrated that structural problems require structural solutions.

For Regulators

Establish Basel IV: The Attention Market Framework

The 2008 financial crisis demonstrated that systemic risk requires comprehensive regulatory architecture. Attention markets demand equivalent structure.

Basel IV: Core Principles for Attention Markets

Principle 1: Attention Leverage Limits

Platforms must maintain attention leverage ratios below sustainable thresholds:

Maximum Attention Leverage Ratio: 1.5:1

- Platforms may not demand more than 1.5 hours of attention for every 1 hour users can sustainably provide

- Calculated based on daily active users and total engagement demand (notifications, feed updates, algorithmic prompts)

- Exceeding leverage limits triggers mandatory reduction protocols

Enforcement Mechanism:

- Quarterly leverage ratio reporting required

- Independent audit of attention demand calculations

- Escalating penalties for sustained leverage violations

- Mandatory user notification when platform operates above 1.2:1

Principle 2: Attention Liquidity Requirements

Platforms must enable users to ”withdraw” attention without penalty:

Seamless Exit Standard

- Users can export complete identity, relationships, and contribution history

- No degradation of service quality during exit preparation period

- Zero switching costs imposed through data portability restrictions

- Relationship graph portability (connections remain accessible)

This prevents ”attention bank runs” — situations where users want to reduce engagement but cannot due to exit costs.

Principle 3: Cognitive Stress Testing

Platforms must undergo regular assessment of population-level cognitive impact:

Annual Stress Test Requirements:

- Model platform impact on user attention capacity under normal conditions

- Simulate attention demand under 1.5x growth scenario

- Assess cognitive load distribution across user demographics

- Identify vulnerable populations experiencing attention insolvency

Testing Protocol:

- Independent cognitive research teams conduct assessments

- Results publicly disclosed (like bank stress tests)

- Platforms failing stress tests must reduce extraction or face restrictions

Principle 4: Systemic Risk Classification

Platforms above threshold size classified as Attention-Systemically Important Platforms (A-SIPs):

Classification Triggers:

- Daily active users exceeding 100 million

- Average attention extraction exceeding 45 minutes per user daily

- Market share of attention time above 15% in any region

- Cross-platform attention leverage (operating multiple high-engagement platforms)

A-SIP Requirements:

- Enhanced leverage ratio limits (1.3:1 maximum)

- Quarterly cognitive stress testing

- Mandatory Portable Identity integration within 24 months

- Resolution planning (attention market exit strategy that prevents user lock-in)

- Systemic risk capital reserves (fund supporting platform-to-platform transition infrastructure)

Principle 5: Attention Market Transparency

Platforms must disclose attention economics:

Required Disclosures:

- Current attention leverage ratio (updated quarterly)

- Notification frequency and interruption metrics

- Algorithmic amplification rates

- User cognitive load scores by demographic

- Contribution to regional GASI scores

Public Dashboard: Regulatory body maintains public dashboard showing:

- Platform-by-platform leverage ratios

- Regional attention solvency trends

- Systemic risk indicators

- Comparative metrics across platforms

Principle 6: Portable Identity Mandate

All platforms above minimum threshold must integrate Portable Identity:

Timeline:

- Year 1: A-SIPs must implement Portable Identity core protocols

- Year 2: Platforms with 50M+ users must implement

- Year 3: Platforms with 10M+ users must implement

- Year 5: Universal requirement for commercial platforms

Integration Standards:

- Cryptographic identity ownership

- Full relationship graph portability

- Contribution history preservation and verification

- Cross-platform reputation interoperability

Principle 7: Cognitive Health Capital Requirements

Platforms must hold ”cognitive capital reserves” funding attention recovery:

Reserve Calculation: Platforms must contribute to attention recovery fund:

- 0.5% of revenue for platforms operating at 1.2-1.5:1 leverage

- 2% of revenue for platforms exceeding 1.5:1 leverage

- 5% of revenue for platforms exceeding 2:1 leverage

Fund Usage:

- Public attention literacy programs

- Cognitive health research

- Attention debt recovery initiatives

- Portable Identity infrastructure development

Implementation Timeline

Phase 1: Foundation (Months 0-12)

- Establish regulatory authority for attention markets

- Define measurement standards for attention leverage and solvency

- Begin GASI data collection and reporting

Phase 2: Classification (Months 12-24)

- Identify A-SIPs requiring enhanced oversight

- Begin mandatory leverage ratio reporting

- Implement cognitive stress testing protocols

Phase 3: Standards Enforcement (Months 24-36)

- Enforce attention leverage limits

- Require A-SIP Portable Identity integration

- Establish attention market transparency dashboards

Phase 4: Universal Coverage (Months 36-60)

- Extend Portable Identity mandate to all qualifying platforms

- Establish cross-border regulatory cooperation

- Full Basel IV framework operational

Regulatory Precedent

This framework draws on proven regulatory models:

- Basel III (financial leverage and capital requirements)

- Solvency II (insurance risk assessment)

- GDPR (cross-border enforcement and significant penalties)

- Clean Air Act (measurable harm standards and market-based solutions)

The architecture is not experimental. It adapts established regulatory principles to attention markets.

For Health Authorities

Classify Attention Debt as Public Health Issue:

Attention insolvency creates population health impacts requiring public health response:

- Establish attention capacity as health determinant (like nutrition or sanitation)

- Monitor population attention debt metrics (like obesity or disease prevalence)

- Fund research on sustainable attention allocation (like dietary guidelines)

- Integrate Portable Identity into digital health policy (as preventive infrastructure)

WHO Role:

The World Health Organization should establish attention architecture as determinant of population health, creating frameworks for sustainable digital infrastructure analogous to clean water or sanitation standards.

For Economists

Develop Attention Economics Framework:

Create rigorous economic analysis of attention markets:

- Establish attention as economic asset class with measurable value

- Model platform extraction economics and systemic risk

- Calculate costs of attention debt at micro and macro scales

- Analyze Portable Identity as structural intervention

Academic Infrastructure:

This requires serious economic research, not pop psychology. The field of attention economics should be as rigorous as financial economics.

For Platform Industry

Transition to Sustainable Business Models:

Platforms must recognize that extraction economics are unsustainable:

- Current models create escalating regulatory risk

- Cognitive default events create reputation and liability exposure

- Portable Identity transition is inevitable

- Early adoption enables competitive advantage

Strategic Choice:

Platforms can lead the transition to sustainable architecture, or be forced into it by regulatory intervention after crisis recognition. Early movers gain advantage.

THE INEVITABILITY

Attention debt will be recognized as systemic crisis.

Not because it is convenient. But because the symptoms are becoming undeniable.

Recognition Indicators Already Visible:

Population health data shows accelerating attention-related disorders. Economic analysis reveals productivity paradoxes. Democratic systems show declining deliberative capacity. Educational outcomes decline despite resource increases.

These are attention insolvency symptoms becoming measurable at scale.

The Question Is Timing:

Will recognition come proactively — enabling managed transition to sustainable architecture — or reactively, after cognitive default events force emergency intervention?

2008 demonstrated the cost of delayed recognition. Financial crisis warning signs existed years before collapse, but structural intervention occurred only after cascade failure.

Attention crisis warning signs exist now. The question is whether intervention occurs before cascade.

THE DOCTRINE

Let it be stated clearly:

You cannot build an economy on debt that can never be repaid.

This principle was learned in 2008 at tremendous cost. It applies equally to attention economics.

You cannot build a civilization on attention that can never be sustainably provided.

Current platform business models require infinite attention growth in finite human capacity. This mathematics guarantees insolvency. The only question is recognition timing.

Portable Identity is the Basel III of digital architecture.

It does not request voluntary extraction reduction. It changes structural incentives so extraction no longer generates sustainable revenue. This is how systemic risk is eliminated: not through asking actors to change behavior, but through changing architecture so destructive behavior is no longer economically viable.

The parallel is exact. The solution is architectural. The timing is urgent.

THE CALL

To financial regulators:

Recognize that attention markets operate on the same structural dynamics that caused 2008 collapse. Establish Basel III equivalent for digital platforms. Mandate Portable Identity as systemic risk prevention.

To health authorities:

Classify attention debt as population health crisis requiring structural intervention. Establish attention capacity as health determinant. Integrate Portable Identity into public health frameworks.

To economists:

Develop rigorous attention economics. Calculate insolvency at individual and population scales. Model Portable Identity as structural intervention. Establish this as serious field of economic research.

To platforms:

Recognize that extraction business models create regulatory, reputational, and systemic risk. Transition to sustainable architecture before forced intervention. Lead the shift to value-based competition.

To policymakers:

Understand that this is structural crisis requiring structural response. Do not repeat 2008’s lesson: recognize insolvency before cascade forces emergency intervention.

THE TIMELINE

The mathematics are clear. The symptoms are measurable. The solution is architectural.

In 2008, financial regulators learned that debt exceeding asset value creates systemic collapse.

In 2025, we must learn that attention demand exceeding cognitive capacity creates systemic collapse.

The question is not whether this recognition occurs.

The question is whether it occurs before or after population-scale cognitive default.

History will record whether we recognized the crisis in time to implement structural solutions — or whether we repeated 2008’s pattern of ignoring mathematical impossibility until cascade failure forced intervention.

Portable Identity is not optional infrastructure.

It is the attention solvency framework that prevents civilizational cognitive default.

The only question remaining is: how much longer before we build it?

The Attention Debt Crisis establishes that digital platforms operate on mathematically unsustainable extraction economics identical to pre-2008 financial leverage. This analysis introduces three foundational frameworks: the Attention Leverage Ratio (measuring platform extraction risk), the Global Attention Solvency Index (tracking systemic health), and Basel IV (providing comprehensive regulatory architecture). Together with Portable Identity as structural solution, these frameworks enable the transition from extraction economics to sustainable attention markets — not through voluntary behavior change, but through architectural transformation of platform incentives.

Rights and Usage

All materials published under PortableIdentity.global — including definitions, protocol frameworks, semantic standards, research essays, and theoretical architectures — are released under Creative Commons Attribution–ShareAlike 4.0 International (CC BY-SA 4.0).

This license guarantees three permanent rights:

1. Right to Reproduce

Anyone may copy, quote, translate, or redistribute this material freely, with attribution to PortableIdentity.global.

How to attribute:

- For articles/publications:

“Source: PortableIdentity.global” - For academic citations:

“PortableIdentity.global (2025). [Title]. Retrieved from https://portableidentity.global”

2. Right to Adapt

Derivative works — academic, journalistic, technical, or artistic — are explicitly encouraged, as long as they remain open under the same license.

Portable Identity is intended to evolve through collective refinement, not private enclosure.

3. Right to Defend the Definition

Any party may publicly reference this manifesto, framework, or license to prevent:

- private appropriation

- trademark capture

- paywalling of the term “Portable Identity”

- proprietary redefinition of protocol-layer concepts

The license itself is a tool of collective defense.

No exclusive licenses will ever be granted.

No commercial entity may claim proprietary rights, exclusive protocol access, or representational ownership of Portable Identity.

Identity architecture is public infrastructure — not intellectual property.

2025-11-23