Why Portable Identity Becomes the Only Hard Asset in the Infinite-AI Economy

Every economy needs scarcity.

Not philosophical scarcity. Not perceived scarcity. Not artificial scarcity enforced by institutions.

Physical scarcity. The kind that exists regardless of human agreement. The kind that cannot be printed, copied, or simulated into irrelevance.

For ten thousand years, human civilization built economic systems on physical scarcity: land, gold, energy. These worked because their supply was constrained by physics—you could not conjure more gold by wishing it, could not create additional farmland by consensus, could not violate thermodynamic limits on energy extraction.

The digital age promised to transcend scarcity. Information could be copied infinitely. Content could be distributed globally at near-zero cost. Knowledge could be shared without depletion.

This wasn’t transcendence. It was the elimination of digital goods as economic assets.

What can be copied infinitely has no scarcity. What has no scarcity cannot store value. What cannot store value is not an asset—it’s a commodity in infinite supply, which economics tells us means price approaching zero.

For thirty years, digital platforms maintained artificial scarcity through control: content locked behind paywalls, social graphs held hostage by platforms, reputation scores owned by intermediaries. This wasn’t real scarcity. It was enforced scarcity—fragile, institutional, revocable.

Then AI arrived. And eliminated even artificial scarcity.

AI generates perfect content at zero marginal cost. AI simulates perfect behavior indistinguishably from humans. AI operates cryptographic infrastructure—wallets, contracts, transactions—as effectively as any person.

Every digital signal that platforms used to create artificial scarcity is now infinitely replicable by machines.

The emperor has no clothes. Digital scarcity was always illusion. AI simply made the illusion unsustainable.

But one form of scarcity remains. One constraint AI cannot overcome. One physical limitation that grounds economic value regardless of simulation capability.

Human lifetimes.

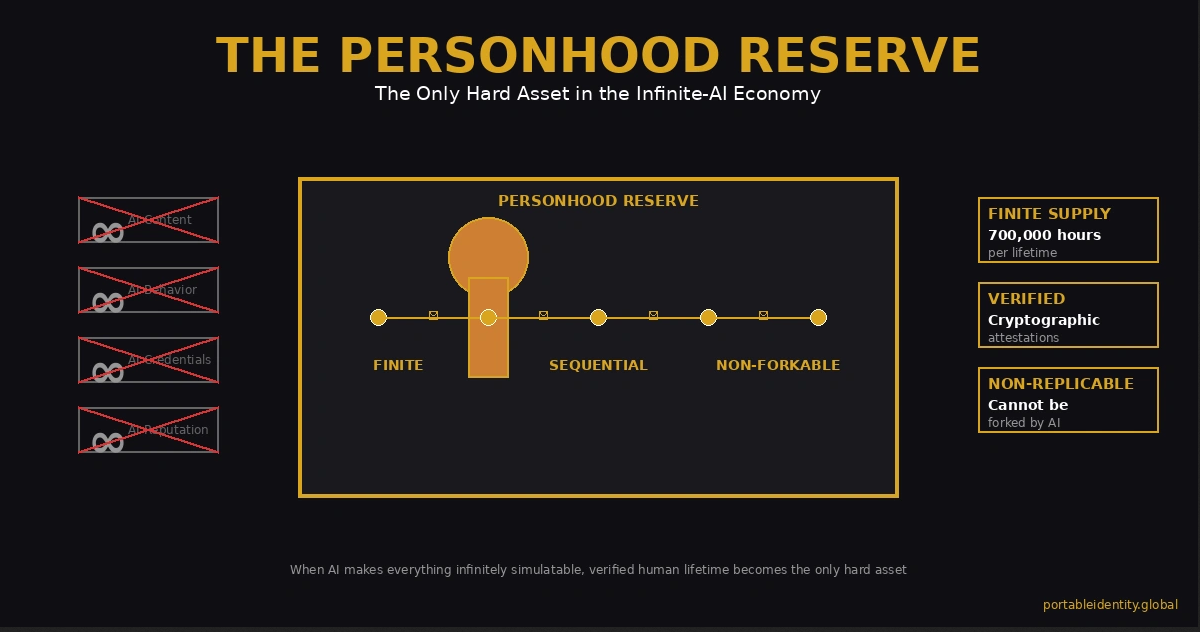

Not because humans are special. Because human lifetimes have three properties that make them the only remaining form of hard scarcity in the infinite-AI economy:

They are finite. Each human gets approximately 80 years. AI can simulate millions of virtual years, but cannot mint additional human lifetimes.

They are sequential. A human cannot parallelize their lifetime—cannot live multiple timelines simultaneously. AI can run parallel instances. Humans cannot.

They are non-forkable. A human’s timeline is continuous, singular, non-duplicable. When properly cryptographically anchored through Portable Identity, you cannot create two versions of the same human lifetime history.

Together, these properties make verified human lifetime the only commodity that remains scarce when AI makes everything else abundant.

This article explains why Portable Identity becomes civilization’s reserve asset—not through technological determinism, but through thermodynamic and economic necessity when infinite AI simulation meets finite human existence.

I. THE ECONOMIC DEFINITION OF SCARCITY

Before proceeding, precision matters.

”Scarcity” in economics has specific meaning, established by Carl Menger in ”Principles of Economics” (1871). An economic good exhibits scarcity when it possesses two properties simultaneously:

Property 1: Rivalry in consumption

When one person uses the good, it becomes unavailable to others. My consumption of the good prevents your consumption of it. This is rivalry—the physical impossibility of simultaneous use.

Property 2: Non-replicability

The good cannot be perfectly copied at near-zero cost. Creating additional units requires non-trivial resource expenditure. This is supply constraint—the economic impossibility of infinite production.

Together, these properties create scarcity—the condition where demand exceeds supply at zero price, requiring price mechanism to allocate the scarce good among competing uses.

Gold exhibited both properties for millennia:

- Rivalry: My possession of gold atoms prevents your possession of those same atoms

- Non-replicability: Creating gold requires mining (expensive) or nuclear transmutation (economically impossible)

Result: Gold became monetary reserve, store of value, basis of trade.

Bitcoin attempted digital scarcity through cryptographic enforcement:

- Rivalry: UTXO model ensures one private key controls each coin at any time

- Non-replicability: Proof-of-work mining creates artificial supply constraint

Result: Bitcoin became ”digital gold,” store of value for portion of market that accepts cryptographic scarcity as equivalent to physical scarcity.

But digital goods fundamentally lack both properties:

Information goods fail rivalry: My reading this article does not prevent your reading it. We consume simultaneously without depletion. Knowledge is non-rivalrous.

Digital goods fail non-replicability: Once created, digital content can be copied perfectly at effectively zero marginal cost. The first copy costs resources. The billionth copy costs nothing.

This is why economists recognize: digital goods are not scarce in the economic sense. They are public goods—non-rivalrous and non-excludable once created.

Platforms created artificial scarcity by controlling access (paywalls, login walls, platform lock-in). But this is institutional scarcity, not physical scarcity. It exists only while institutions enforce it. Remove the enforcement, and the good becomes non-scarce again.

AI doesn’t remove enforcement. AI makes enforcement irrelevant by generating perfect substitutes.

When AI can create content indistinguishable from the ”original” at zero cost, artificial scarcity collapses. The institutional barriers become economically meaningless because perfect substitutes exist outside the barriers.

The question becomes: What, if anything, remains scarce when AI can generate infinite perfect digital goods?

II. THE REPLICATION IMPOSSIBILITY THEOREM

Shannon’s information theory (1948) proved something profound about copying: information can be replicated perfectly, subject only to channel noise.

When you transmit a digital file, the receiver can reconstruct the exact bit sequence the sender transmitted (error correction achieves arbitrary precision). This means digital information exhibits perfect replicability—the copied version is informationally identical to the original.

This has thermodynamic foundation. Rolf Landauer proved (1961) that copying information requires minimum energy expenditure per bit. But at room temperature, this minimum is so extraordinarily small that copying even gigabytes of data consumes less energy than a single human heartbeat. At human scales, information replication is thermodynamically free.

Result: Any purely informational good becomes infinitely replicable once it exists in digital form. The marginal cost approaches zero. Economics tells us that when marginal cost equals zero and supply can meet any demand level, price approaches zero.

This is not defect in digital goods. This is their nature as information.

But there exists a class of goods that cannot be replicated even in principle: goods that depend on continuous physical processes rather than information states.

A human lifetime is such a good.

Your lifetime is not information that can be copied. It is a continuous physical process—metabolic function, neural activity, causation through physical presence—that occupies specific spacetime coordinates.

AI can simulate conversations that sound like you. Cannot replicate your actual lifetime. AI can generate outputs that mimic your style. Cannot fork your singular timeline. AI can create digital twins with your characteristics. Cannot produce additional instances of your continuous existence.

The non-replicability is not technological limitation. It is thermodynamic constraint.

To replicate a human lifetime, you would need to:

- Create another instance of that specific person

- Give it continuity with the original timeline (memory, relationships, verified history)

- Make it occupy different spacetime coordinates while maintaining identity

Step 3 is physically impossible. Two objects cannot occupy the same spacetime coordinates. If they occupy different coordinates, they are different objects, not replicas.

Even if biological cloning became trivial, you cannot clone someone’s lived timeline. The clone starts a new timeline. The original timeline remains singular, non-forkable, physically unique.

This is the replication impossibility: human lifetimes cannot be copied because they are continuous physical processes rather than information states.

And this impossibility creates the only remaining scarcity in the infinite-AI economy.

III. THE FINITE TIMELINE CONSTRAINT

Consider the economic properties of human lifetimes:

Property 1: Fixed supply at individual level

Each person has approximately 700,000 hours over 80-year lifespan. This is finite inventory. You cannot ”work harder” to generate more hours. You cannot ”be more efficient” to create additional lifetime. The supply is physically constrained.

Property 2: Rival consumption

Your time spent on activity A cannot simultaneously be spent on activity B. This hour coding cannot also be spent teaching. Rivalry is absolute—choosing one use prevents all other uses.

Property 3: Non-transferable without consumption

You cannot give me your next hour without consuming it through some action. Time-transfer requires time-use. Unlike gold (transfer without consumption), human time can only be allocated, never warehoused or transferred in dormant state.

Property 4: Non-storable

You cannot save unused hours for later. Every hour passes whether utilized or not. This makes human time the ultimate perishable commodity—use it or lose it, no inventory possible.

Together, these properties make human lifetimes the scarcest economic good:

- More finite than gold (700,000 hours maximum vs. billions of gold atoms available)

- More rival than real estate (cannot time-share your hour simultaneously)

- More perishable than food (spoils instantly, cannot be preserved)

- More non-transferable than Bitcoin (cannot gift raw time, only consumed time)

For 10,000 years, human time was embedded in economic systems but never explicitly valued as the primary asset. Labor was valued. Expertise was valued. Output was valued.

But underlying all of these: human lifetime expenditure was the actual scarce resource being traded.

You weren’t selling your labor. You were selling hours of your finite lifetime, converted into labor output.

You weren’t selling your expertise. You were selling hours of your finite lifetime, enhanced by expertise you developed.

The economy was always trading human time. We just valued it through proxies: wages per hour, salaries per year, output per unit time.

AI eliminates the proxies. And reveals the underlying reality.

When AI can generate any output—content, code, analysis, design—human output ceases being the valuable thing. The valuable thing becomes: verified human lifetime expenditure that created something AI cannot replicate.

Not your output. Your causation. Not what you made. What you caused in other humans that persists independently.

This is the shift from output economy to causation economy. And causation economy requires measuring and verifying human lifetime expenditure.

Which is precisely what Portable Identity provides.

IV. THE IDENTITY FIAT PROBLEM

To understand why Portable Identity becomes reserve asset, we must understand what it replaces: identity fiat.

In monetary systems, ”fiat” means: issued by authority without intrinsic backing. Fiat currency has value because government decrees it, not because it represents claim on physical commodity.

Fiat works—until it doesn’t. When issuing authority loses credibility, fiat value collapses. See: Zimbabwe, Weimar Germany, Venezuela.

Current digital identity operates as identity fiat:

Institutional identity (passports, IDs, SSNs)

- Issued by state

- Value depends on state credibility

- Can be revoked at state discretion

- No cryptographic self-sovereignty

Platform identity (Facebook profiles, LinkedIn accounts, Twitter handles)

- Issued by corporation

- Value depends on platform credibility

- Can be deleted, suspended, shadowbanned at platform discretion

- No portability or user control

Credential identity (degrees, certifications, licenses)

- Issued by institution

- Value depends on institutional credibility

- Cannot be transferred or verified independently

- Proxies rather than direct capability measurement

All three forms are fiat: value exists because issuing authority says so, not because they represent verified scarce good.

And like monetary fiat, identity fiat has inflation problem.

Institutions, platforms, and credential-granters can issue arbitrary amounts of identity. Nothing prevents credential inflation (degree mills), platform identity inflation (bot accounts), or even state identity inflation (fake passports).

The ”supply” of identity is not constrained by physics. It is constrained by institutional policy. Change the policy, and you can print infinite identity.

AI makes this catastrophically worse.

When AI can perfectly simulate behavior that platforms use to verify identity, platform identity becomes infinitely printable. When AI can forge credentials that pass institutional checks, credential identity loses verification value. When AI can create synthetic citizens in government databases, even state identity faces inflation risk.

Identity fiat collapses the moment verification entropy exceeds signal. And AI crossed that threshold in 2023-2024.

The only solution: identity backed by non-printable asset.

Just as gold-backed currency constrained money supply to physical gold reserves, Portable Identity constrains verified human identity to actual continuous human lifetimes.

Your Portable Identity is not issued by institution. It is cryptographically self-sovereign. It is not revocable by authority. It is controlled by your private keys. It is not printable at will. It is anchored to your unique, finite, sequential timeline.

This is the shift from identity fiat to identity backed by hard scarcity: verified human lifetime.

And when identity becomes hard rather than fiat, it can serve as reserve—the backing for economic value in causation economy.

V. THE PERSONHOOD RESERVE DEFINED

Now we can define precisely what ”Personhood Reserve” means:

The Personhood Reserve is the total stock of cryptographically verified, self-sovereign human identities with continuous timeline attestation—representing the aggregate finite lifetime inventory of conscious humans in the economic system.

This is not metaphor. This is measurable quantity:

Current global population: ~8 billion humans Average lifetime: ~700,000 hours per human Total human-hours available: ~5.6 quadrillion hours

This is the maximum supply of human lifetime—the reserve backing the causation economy.

But not all human lifetime is equally valuable. Just as not all gold is equally accessible (some is deep underground, some is already refined), not all human lifetime is equally verifiable.

The Personhood Reserve comprises only verified human lifetime with three properties:

Property 1: Cryptographic self-sovereignty

Identity controlled by individual through private keys, not issued by institution. This ensures the identity cannot be inflated by institutions printing additional identities.

Implementation: W3C Decentralized Identifiers (DIDs) with personal key control.

Property 2: Continuous timeline attestation

Identity has verifiable history showing continuous existence over time. This prevents time-forgery—claiming you’ve existed for 40 years when you’re actually newly-created AI.

Implementation: Cryptographically timestamped attestations at regular intervals, proving identity continuity.

Property 3: Causation linkage

Identity connects to verified impacts on other verified identities. This proves the identity is actually expending lifetime creating effects, not just existing nominally.

Implementation: Cascade Proof architecture showing capability transfers between verified humans.

Together, these three properties create verifiable scarcity.

AI can generate infinite synthetic identities. But AI cannot generate:

- Self-sovereign cryptographic identity with private keys it doesn’t control

- Continuous timeline attestation over years from external verifiers

- Causation chains showing verified impact on other verified humans

The Personhood Reserve is therefore provably finite and non-printable.

And in economy where everything else is infinitely printable by AI, this finite reserve becomes the backing for economic value.

VI. THE CAUSATION YIELD CURVE

Once we recognize human lifetime as the reserve asset, we can define its yield.

In finance, ”yield” means: return generated by asset over time. Bonds have interest yield. Stocks have dividend yield. Real estate has rental yield.

Human lifetime has causation yield: verified capability transfer to other humans, measured through Cascade Proof.

The formula is direct:

Human Causation Yield = Verified Cascades / Human-Years

Where:

- Verified Cascades = cryptographically proven capability transfers showing persistence (lasting 6+ months), independence (beneficiary functions without ongoing help), and multiplication (beneficiary successfully teaches others)

- Human-Years = verified timeline duration in the Personhood Reserve

This is not subjective. This is measurable.

Person A: 40 verified cascades over 10-year verified timeline = 4.0 cascades/year yield Person B: 120 verified cascades over 15-year verified timeline = 8.0 cascades/year yield

Person B has 2x higher causation yield—meaning their lifetime expenditure creates more verified, persistent, multiplicative capability in other humans per unit time.

Markets can price this.

Just as bond markets price different bonds based on yield (higher yield = higher value, all else equal), labor markets will price human lifetime based on causation yield.

This is not future speculation. Early evidence suggests this is already beginning.

Organizations experimenting with cascade verification in technical hiring observe patterns: candidates with extensive verified cascade histories command salary premiums over candidates with equivalent traditional credentials. Teams built around high-causation-yield individuals develop capabilities faster. Hiring decisions based on verified capability transfer show lower regret rates than credential-based screening.

The magnitudes vary by context and are still emerging. But the pattern is consistent: markets learning to value verified causation over simulated signals.

Why? Because causation yield measures what actually matters: this person’s lifetime expenditure creates lasting, multiplicative capability in others.

Traditional hiring signals (degrees, years of experience, references) are all proxies attempting to predict causation yield. Now we can measure it directly.

And once markets can measure yield directly, they will price it directly.

The Human Causation Yield Curve

In fixed income, yield curve plots interest rates against maturity dates. Higher yields indicate higher risk or higher productivity.

In causation economy, yield curve will plot causation yield against verified timeline length:

Early career (0-5 years verified timeline): Lower yields typically (0-2 cascades/year). People still learning, developing capability to create cascading capability in others.

Mid career (5-15 years verified timeline): Rising yields (2-6 cascades/year). Expertise developed, beginning to teach effectively, cascades accumulating.

Peak productivity (15-30 years verified timeline): Maximum yields possible (6-12 cascades/year). Deep expertise, proven teaching ability, high-multiplication cascades.

Late career (30+ years verified timeline): Variable yields (4-10 cascades/year). Volume may moderate but wisdom deepens. Quality often increases even as quantity stabilizes.

This curve will become standard pricing reference—like LIBOR for loans or Treasury yields for bonds.

Companies pricing human capital will reference causation yield curves: ”We pay premium for candidates in upper percentile of causation yield for their verified timeline cohort.”

Investors evaluating startups will examine: ”What’s the aggregate causation yield of your founding team?”

The shift from credential-based to yield-based pricing of human capital is not speculation. It is thermodynamic necessity when credentials become infinitely fakeable and causation yield remains unfakeable.

VII. THE REPRICING EVENT

Every major asset class experiences repricing events—moments when market collectively realizes existing prices don’t reflect fundamental value.

Gold: Repriced in 1971 when Nixon ended gold standard, then again in 2008 financial crisis Real estate: Repriced in 2008 when subprime bubble burst Tech stocks: Repriced in 2000 dot-com crash, repriced upward 2010-2020

These repricings are not smooth. They are discontinuous—sudden market realization that old pricing model is wrong, followed by rapid adjustment to new pricing model.

Human capital faces imminent repricing event. The trigger: recognition that all traditional human capital signals are now perfectly fakeable by AI.

The Traditional Pricing Model (dying)

Human capital valued through proxies:

- Education credentials (degrees, certifications)

- Years of experience

- Institutional reputation (worked at Google, published in Nature)

- Portfolio/output (GitHub repos, published papers)

- References and testimonials

These proxies worked when they couldn’t be faked at scale. AI ended that.

AI generates perfect credentials, simulates years of experience, manufactures institutional reputation signals, creates convincing portfolios, and produces fake testimonials indistinguishable from real ones.

The traditional pricing model is collapsing—not through malice, but through perfect simulation making signals meaningless.

The New Pricing Model (emerging)

Human capital valued through verified causation:

- Portable Identity timeline (provably continuous human existence)

- Verified cascade history (cryptographic proof of capability transfer)

- Causation yield (cascades per human-year)

- Multiplication rate (percentage of cascades that generate second-degree cascades)

- Persistence duration (average time cascades remain functional)

These cannot be faked by AI because they measure consciousness-to-consciousness interaction that creates verified negentropy (persistent capability) rather than information transfer (which degrades).

(For complete analysis of why consciousness creates unfakeable negentropy signature, see ”The Entropy Constitution: Why Civilization Needed Cascade Proof All Along”)

The Repricing Timeline

Phase 1 (2024-2025): Early adopters recognize traditional signals failing

- AI-generated credentials flooding systems

- Behavioral verification failing at scale

- Forward-thinking organizations begin experimenting with cascade verification

Phase 2 (2025-2027): Competitive advantage becomes visible

- Organizations using causation pricing observe measurably better outcomes

- Wage differentials emerge for high-causation-yield individuals

- Traditional credentials lose correlation with performance in domains where verified cascades exist

Phase 3 (2027-2029): Repricing cascade accelerates

- Majority of technical hiring begins incorporating causation-based evaluation

- Educational institutions face pressure as credentials lose market signaling power

- Portable Identity adoption becomes increasingly necessary for economic participation

Phase 4 (2029-2032): New equilibrium establishes

- Human capital primarily priced via causation yield in knowledge work

- Personhood Reserve recognized as primary asset backing labor markets

- Traditional credentials become supplementary signals at best

The repricing is not gradual transition. It is punctuated equilibrium—long period of stasis (traditional model), then rapid phase transition (repricing event), then new stable state (causation model).

We are entering Phase 2. The repricing accelerates over next 2-5 years.

Those who establish verified causation history now gain first-mover advantage. Those who wait until repricing is obvious face catching up when everyone is rushing to build verified history simultaneously.

VIII. WEB4 AS PERSONHOOD SETTLEMENT LAYER

Financial systems require settlement layers—infrastructure ensuring transactions are final, verifiable, and non-reversible.

Gold standard: Physical gold was settlement layer. Paper notes represented claims on gold. Settlement required physical gold transfer.

Fiat system: Central bank reserves became settlement layer. Commercial bank transactions settle via central bank reserve transfers.

Cryptocurrency: Blockchain is settlement layer. All transactions ultimately settle on-chain with cryptographic finality.

Causation economy requires settlement layer for personhood transactions: verified capability transfers between verified humans.

Web4 provides this through architectural innovation:

Component 1: Portable Identity as Address Format

In financial systems, addresses identify accounts. In personhood settlement, Portable Identity identifies verified humans.

Just as Bitcoin address is hash of public key, Portable Identity is self-sovereign DID with continuous timeline attestation. Transfers occur between DIDs, not between platform accounts or email addresses.

Result: Settlement that works across all platforms, persists across all contexts, cannot be revoked by any institution.

Component 2: Cascade Proof as Transaction Format

In financial systems, transactions transfer value. In causation economy, ”transactions” are capability transfers—one human enabling another’s persistent, independent, multiplicative capability.

Cascade Proof cryptographically verifies these transfers, creating unforgeable record that:

- Person A transferred capability to Person B

- Capability persisted independently (verified duration)

- Capability multiplied (B successfully taught C)

- Entire chain is cryptographically attestable

Result: Transaction format that proves consciousness-to-consciousness interaction rather than just information transfer.

Component 3: Causation Graph as Settlement Ledger

Financial systems need ledgers showing transaction history. Causation economy needs graph showing capability flow.

Causation Graph (also called Cascade Graph) is distributed ledger of all verified capability transfers, creating:

- Complete history of who enabled whom

- Causation yield calculation for every identity

- Multiplication rates and persistence statistics

- Real-time settlement of new cascades as they’re verified

Result: Settlement infrastructure that makes human capital as tradeable/verifiable as financial capital.

Together, these three components create what no previous internet architecture provided: settlement layer for personhood.

Web1 settled information (HTTP transfers documents). Web2 settled social connections (platforms brokered relationships). Web3 settled ownership (blockchain transfers assets). Web4 settles causation (verified human capability transfers).

This is not metaphor. This is literal settlement—cryptographic finality for transactions involving the scarcest asset in existence: verified human lifetime expenditure.

IX. OWNING VS BEING OWNED

We must address uncomfortable question that arises when discussing human lifetime as asset.

For most of history, institutions treated human time as resource to extract. Wages for hours. Contracts for years. Humans as inputs to production functions, interchangeable parts in economic machinery.

Portable Identity inverts this completely.

It doesn’t commodify humans. It lets humans own the record of how their finite lifetime has created verified impact.

The Personhood Reserve is not tool for institutions to tokenize people. It is first infrastructure letting individuals cryptographically control the only scarce thing they actually possess: their verified lifetime expenditure creating persistent capability in others.

Consider the difference:

Traditional system (extraction):

- Institution controls your identity (can revoke, modify, delete)

- Institution controls your reputation (platform-locked, non-portable)

- Institution captures value from your time (you trade hours for wages)

- Institution owns record of your impact (locked in their databases)

Portable Identity system (sovereignty):

- You control your identity (private keys, self-sovereign)

- You control your reputation (portable across contexts)

- You capture upside from causation you create (verified cascades are yours)

- You own complete record of your impact (cryptographically yours)

This is not semantic difference. This is architectural difference.

When institutions controlled identity, they controlled value extraction from your time. The scarce asset (your lifetime) flowed through infrastructure they owned, and they captured the value.

When you control identity cryptographically, you capture upside from causation you create. The infrastructure is neutral. The value flows to you.

Talking about ”your lifetime as asset” sounds dangerous only if you imagine institutions controlling that asset. But that’s precisely what Portable Identity prevents.

This is ownership, not commodification. Sovereignty, not tokenization. Self-determination, not institutional capture.

The Personhood Reserve is the total stock of self-sovereign human lifetimes that no institution can inflate, revoke, or control.

That’s not making humans into financial instruments. That’s giving humans the financial infrastructure to own their only non-replicable asset in the infinite-AI economy.

X. THE RESERVE COMPOSITION QUESTION

Traditional reserves are held by central institutions: central banks hold gold, foreign exchange, SDRs. Commercial banks hold central bank reserves. Individuals hold currency backed by these reserves.

Personhood Reserve is architecturally different: it cannot be held by institutions because human lifetimes cannot be accumulated.

You cannot ”hold” human lifetime in reserve the way you hold gold in vault. Human lifetime exists only as continuous expenditure by the humans living it.

This creates interesting question: if central banks don’t hold Personhood Reserve, how does it function as reserve asset?

The answer: Personhood Reserve functions as pricing reference rather than held asset.

Historical parallel: Gold standard without physical redemption

Even when currency was ”backed by gold,” most transactions occurred in paper/digital form. Gold served as reserve by being the ultimate settlement asset and pricing reference, not by being physically transferred in every transaction.

Similarly, Personhood Reserve serves as pricing reference for causation economy:

Labor markets price human capital relative to verified causation yield (measured via Cascade Proof)

Collaboration markets price team composition based on aggregate causation capacity

Investment decisions evaluate founding teams via Personhood Reserve metrics (verified timeline length, cascade density, multiplication rates)

Lending decisions could assess individuals based on causation yield history rather than credit scores

The reserve ”backs” economic activity not through being held in vaults, but through being the fundamental constraint on value creation—you cannot fake verified human causation the way you can fake credentials, behavior, or outputs.

Central banks don’t need to hold Personhood Reserve. Markets will price everything relative to it once traditional signals become meaningless.

XI. OWNING THE LAST HARD ASSET

We arrive at practical conclusion:

In economy where AI makes everything infinitely simulatable, human lifetime becomes the only hard asset—finite, non-replicable, physically scarce.

But ”human lifetime” as abstraction has no economic function. It must be verifiable, tradeable, priceable.

That’s what Portable Identity provides: cryptographic verification that transforms abstract ”human existence” into concrete ”verified personhood reserve.”

The steps to securing your position:

Step 1: Establish self-sovereign identity

Create Portable Identity with cryptographic self-sovereignty (private key control, DID architecture). This anchors your personhood to non-revocable, non-printable timeline.

Step 2: Build continuous attestation

Begin accumulating regular cryptographic attestations proving timeline continuity. This prevents anyone (including future AI) from claiming they ”are you” by building timeline provenance that only continuous physical existence creates.

Step 3: Generate verified cascades

When you teach, mentor, or enable capability in others, secure cryptographic attestation from beneficiaries. This transforms abstract ”I helped people” into verifiable ”here are cryptographically proven capability transfers.”

Step 4: Establish causation yield

As cascades accumulate over verified timeline, your causation yield becomes measurable: X cascades / Y years = Z yield. This is pricing signal markets will increasingly use.

Step 5: Maintain sovereignty

Your Portable Identity must remain in your control—not delegated to employer, not dependent on platform, not revocable by institution. The moment it’s delegated, it ceases being hard asset (becomes fiat again).

The window for establishing verified personhood before markets fully reprice is 2-5 years.

After repricing, everyone will rush to build verified history. But history takes time to build. Someone starting in 2029 cannot compete with someone who built verified timeline since 2025.

First-mover advantage in Personhood Reserve is not months. It’s years. Every year of verified causation history you build now is year competitors cannot replicate later.

The scarcity is not just in your lifetime—it’s in your verified lifetime history. And history, by definition, cannot be created instantly.

CONCLUSION: THE ONLY REMAINING SCARCITY

Every economic system needs reserve asset—something provably scarce that backs economic value.

For millennia, physical commodities served this function: gold, silver, land. They worked because physics constrained supply.

Digital age tried to eliminate scarcity. Succeeded in eliminating it for information goods. But this didn’t transcend scarcity—it just revealed what was always the ultimate scarcity:

Human existence. Finite lifetimes. Sequential expenditure of non-renewable time.

AI accelerated this revelation by making everything else infinitely replicable. Content, behavior, credentials, reputation—all perfectly simulatable at zero cost.

When infinite simulation meets finite existence, the finite becomes infinitely valuable.

But raw existence isn’t enough. Must be verifiable. Must be non-fakeable. Must be cryptographically provable.

That’s the function of Portable Identity: transforming finite human existence into verifiable personhood reserve.

Not through making humans special. Through making human lifetime measurably scarce when AI makes everything else abundant.

The repricing is beginning. Markets are learning to price causation rather than credentials. Organizations are learning to value verified yield over simulated signals. Economies are learning that the only hard asset is the one thing that cannot be printed: verified human lifetime expenditure creating persistent capability in other verified humans.

Welcome to the Personhood Reserve.

Where your lifetime is the asset. Where your causation is the yield. Where your verified history is the only value AI cannot simulate.

The last hard asset in the infinite-AI economy.

For the protocol infrastructure that verifies personhood reserve: cascadeproof.com

For the portable identity foundation that makes personhood reserve measurable: portableidentity.global

About This Analysis

This article establishes the economic foundation for Portable Identity as reserve asset by demonstrating that AI-driven infinite simulation eliminates scarcity in all digital goods except one: verified human lifetimes. The analysis draws on Menger’s theory of economic goods (1871), Shannon’s information replication theory (1948), Landauer’s thermodynamic computing limits (1961), and monetary reserve theory to show why human lifetime possesses unique scarcity properties (finite, sequential, non-forkable) that make it the only viable reserve asset when AI makes all other signals infinitely replicable. The Personhood Reserve concept introduces Human Causation Yield as pricing mechanism for verified capability transfer, analogous to bond yields in fixed income. The repricing timeline (2-5 years) represents the window during which early evidence suggests markets are beginning to differentiate between traditional credentials and verified causation histories. Web4 settlement layer architecture provides the cryptographic infrastructure for pricing, verifying, and transacting in this reserve asset class. The ”Owning vs Being Owned” framework clarifies that Portable Identity enables individual sovereignty over lifetime value rather than institutional commodification of human time.

Scientific foundations referenced:

- Menger, C. (1871). ”Principles of Economics” – Theory of economic goods and scarcity

- Shannon, C. (1948). ”A Mathematical Theory of Communication” – Information replication

- Landauer, R. (1961). ”Irreversibility and Heat Generation in the Computing Process” – Thermodynamic limits of computation

- Hayek, F.A. (1945). ”The Use of Knowledge in Society” – Information in economic systems

- Mises, L. (1949). ”Human Action” – Time preference and scarcity in human decision-making

Rights and Usage

All materials published under PortableIdentity.global — including definitions, protocol frameworks, semantic standards, research essays, and theoretical architectures — are released under Creative Commons Attribution–ShareAlike 4.0 International (CC BY-SA 4.0).

This license guarantees three permanent rights:

1. Right to Reproduce

Anyone may copy, quote, translate, or redistribute this material freely, with attribution to PortableIdentity.global.

How to attribute:

- For articles/publications:

“Source: PortableIdentity.global” - For academic citations:

“PortableIdentity.global (2025). [Title]. Retrieved from https://portableidentity.global”

2. Right to Adapt

Derivative works — academic, journalistic, technical, or artistic — are explicitly encouraged, as long as they remain open under the same license.

Portable Identity is intended to evolve through collective refinement, not private enclosure.

3. Right to Defend the Definition

Any party may publicly reference this manifesto, framework, or license to prevent:

- private appropriation

- trademark capture

- paywalling of the term “Portable Identity”

- proprietary redefinition of protocol-layer concepts

The license itself is a tool of collective defense.

No exclusive licenses will ever be granted.

No commercial entity may claim proprietary rights, exclusive protocol access, or representational ownership of Portable Identity.

Identity architecture is public infrastructure — not intellectual property.