The Institutional Debt Crisis

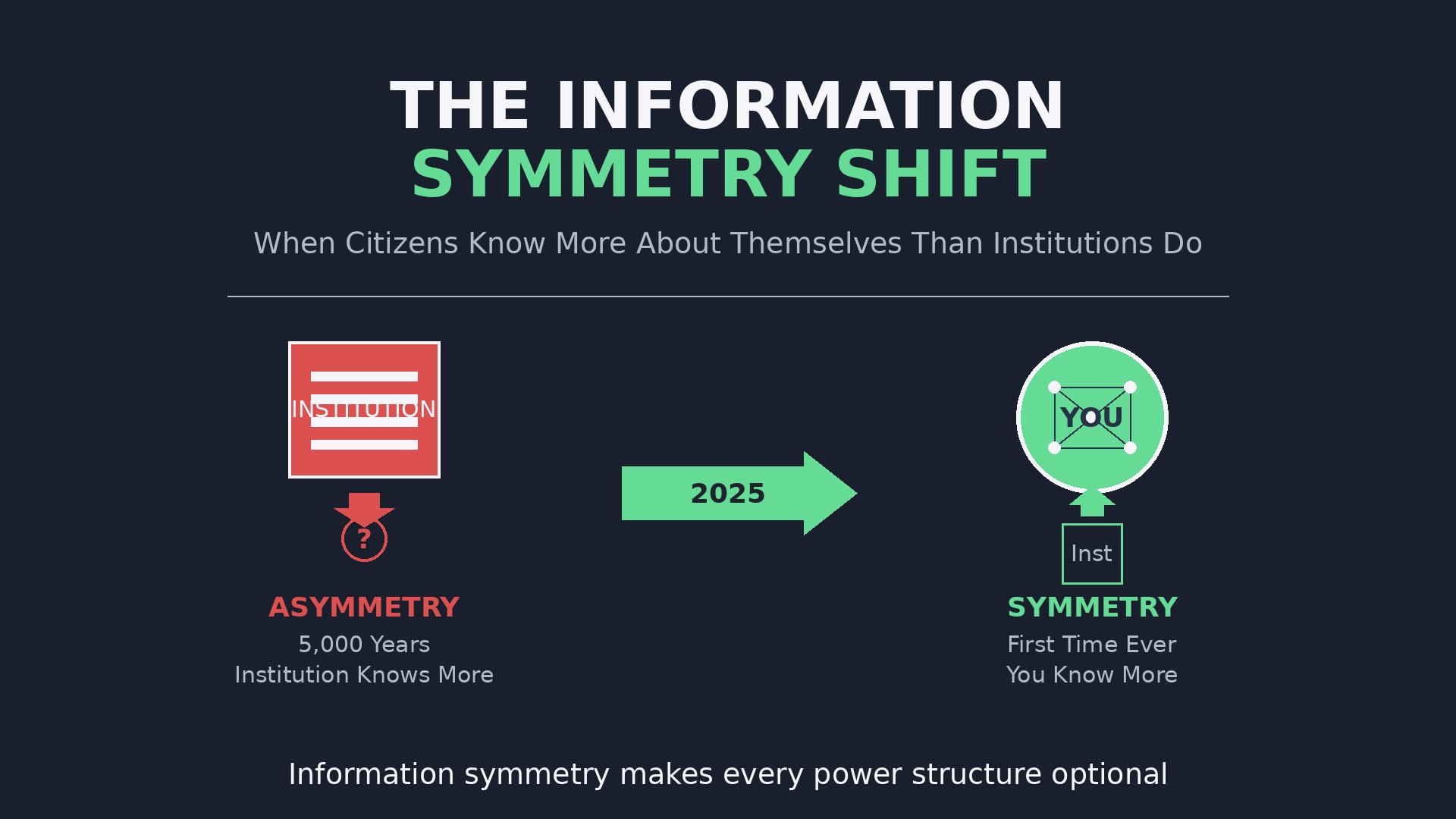

The Trust Debt Coming Due: Why Information Symmetry Triggers Institutional Bankruptcy In 2008, the global financial system collapsed when asset prices exposed that banks had been lying about the quality of their holdings for years. In 2025, the global institutional system will collapse when information symmetry exposes that institutions have been lying about the quality … The Institutional Debt Crisis